A Client Talking Point

Client: Should we change our bond allocation?

As always, I suggest you start with probing questions.

That’s an interesting question, what makes you ask that? Tell me more.

You may find that you and your client end up not even talking about bonds. Instead, the conversation may shift to their concerns around retirement or some other matter. Part of being an active listener is realizing that the initial thing is not always the main thing. Ask more questions. Listen harder.

Bonds, like all investments, are implementation devices. Professionals care about the implementation. We must.

But our clients? They care about themselves, their hopes, and their fears. And they care that they trust you and your firm with the implementation.

But, if we must…

As an example:

That’s a really good question. One of our investment principles is that we don’t make long-term investment changes based on short-term market moves. The market is impossible to predict, especially over the short term. If we make major changes now, it could do more harm to your retirement plan than good.

More, we have been enduring an inflationary economic environment. Importantly, the purpose of bonds in an investment portfolio isn’t to keep up with inflation. In other words, we expect bonds to perform poorly in an inflationary environment.

Stocks, over the long run, prove resilient to inflation. Your house is another great inflationary hedge. Bonds, in contrast, protect near-term cash flow needs from market volatility and they protect against deflation. So, if we switch from inflation to deflation, which is entirely possible, we are going to want bonds in the portfolio to protect your retirement plan.

How does that feel?

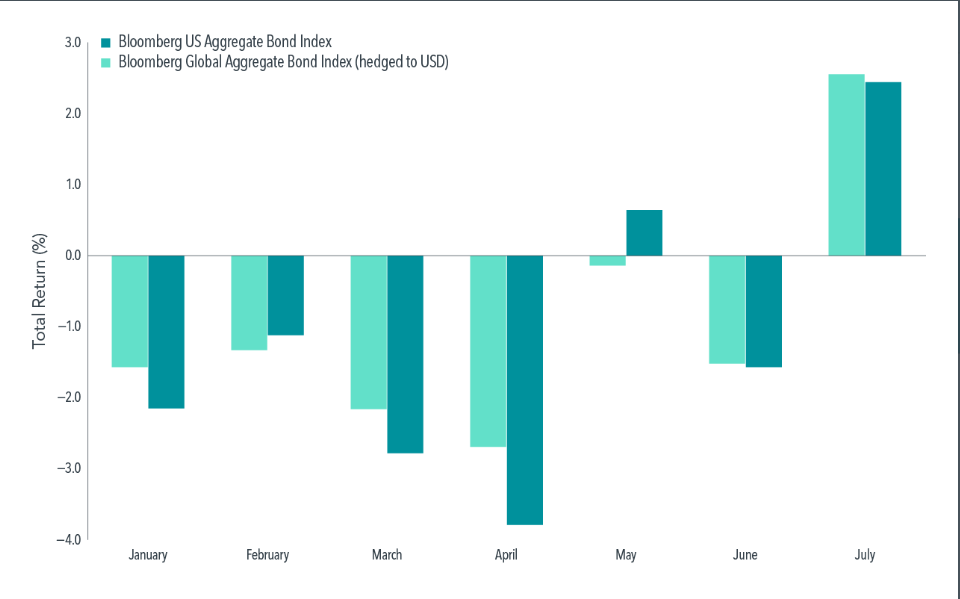

I don’t love the idea of showing clients charts, but we advisors are enamored with them. To that end, this is a great one from Dimensional. As you can see, as inflation expectations declined in July, bonds realized positive returns. Had you, say, shifted all of your intermediate-term bonds to short-term bonds in late April, you would have missed out on the July rebound.

One additional warning: Please, please(!) don’t talk about how, technically, the present value of future cash flows has also declined due to higher inflation and a higher discount rate and therefore it’s a-okay that the bond price has also declined to reflect this.

You’ll do more harm than good. And, no one wants to fall asleep in your office.

An Article to Read (or not)

The Wall Street Journal ran a special report on Personal Investing in its Monday, August 8th edition. The headline was “20 Ideas for Adjusting Your Stock and Bond Portfolio.”

It would have been more appropriately titled, “20 Bad Ideas…”

James Choi, a professor of finance at Yale School of Management, begins with reasonable advice:

Most working-age people’s biggest economic asset is not their already-accumulated savings, but their future wages. Wage growth has low correlation with stock returns, so future wages represent a huge implicit fixed-income holding. That means that most people should hold close to 100% of the money they don’t need to cover regular monthly expenses in stocks.

That’s reasonable, even advisable! But then, we take a dive…

A wrinkle to the above advice is that when stock-market volatility is extremely high, as it has been, it can make sense to temporarily scale back one’s stock positions. That’s because the market’s average return doesn’t increase when volatility is high, so the market is a relatively bad deal during those times.

When the VIX (the market’s forecast of the S&P 500’s volatility over the next month) rises above 30, I start thinking about modestly reducing my stock exposure. In the early summer, I scaled back my stock positions by 5 percentage points. When the VIX hit its all-time high of 83 in March 2020, I reduced my stockholdings by 80 percentage points [Emphasis added].

Oh no, James!

I’m sure there is some data-mined basis for this idea, but imagine suggesting this to a retiree. Even worse, imagine implementing it! Worse still, imagine telling them that they missed out on the recovery because the VIX told you to stay in cash.

What’s the VIX, you ask? Oh well, it’s umm…and it, ughhh, measures…ummmm.

James needs a Nick Murray-style Behavioral Investment Counselor and STAT!

Nannette Abuhoff Jacobson of Hartford funds thinks you should move to a 50/50 blend because the market is going to go down 20% over the next 6-12 months. While other experts recommend you buy stocks with earnings resilience, dividend-paying stocks, ‘lower-risk’ ESG stocks, and/or IT stocks, respectively.

Even David Blanchett, the financial planning industry’s very own and beloved retirement researcher, gets conned by the WSJ journalists into a market call:

Buy annuities because stocks are a bad deal and economic uncertainty is high.

Drivel, all of it.

The Wall Street Journal didn’t ask me, but here’s my submission:

Review your financial plan with your financial planner to ensure your investment allocation is suitable for your risk capacity and financial goals. If ‘yes,’ do nothing. If ‘no,’ adjust accordingly.

Own enough high-quality bonds to match short-term cash needs (2-5 years). Own enough stocks to protect purchasing power and compound wealth over the long-run. Tilt toward value, small-cap, and profitability factors to increase expected returns.

Ignore everything else on this page.

A Market Thought

Keep reading with a 7-day free trial

Subscribe to The Value of Advice to keep reading this post and get 7 days of free access to the full post archives.