The Wall of Worry (Timely Client Letter)

Endlessly climbing (and a client letter example)

Have you seen this chart from J.P. Morgan?

I love it. I’ve seen a thousand charts like this, but J.P. Morgan’s version hits me.

From the beginning of 2007 through January of 2022, the market increased by 333.2%. Wow. Take that sequence of returns!

But really, look at all of those things to be scared of. That’s the Wall of Worry.

And many of them are, indeed, terrifying. September 11th is on there. So are Covid-19, tsunamis, and hurricanes.

Others, though emanating from financial markets, were no less emotionally taxing if not quite as disastrous on a human level.

Yet, the market chugged onward. In fact, it chugged onward not in spite of, but because of all this uncertainty.

That’s the equity premium at work. I’ll accept your short-term volatility and risk of drawdown, and in return, I’ll receive long-term gains.

Deal!

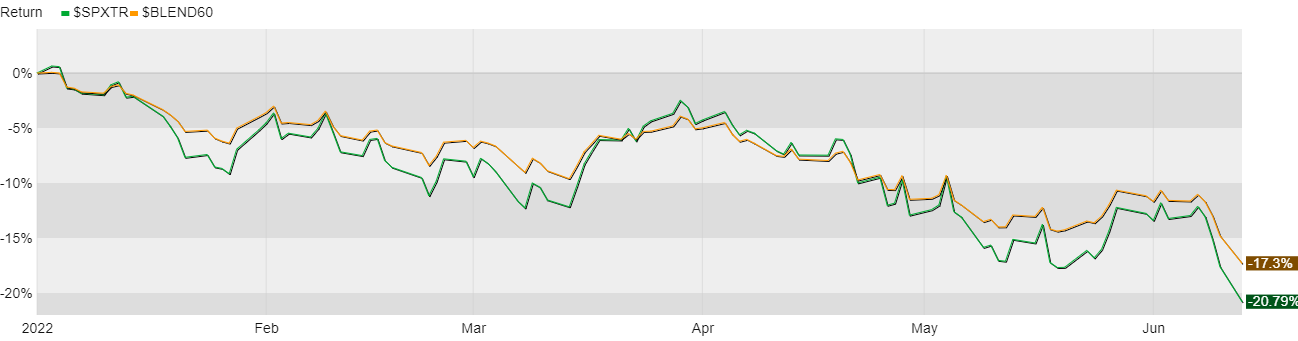

And yet, here we are. Inflation is rampaging, interest rates are increasing, Russia is waging war on Ukraine, geopolitical tensions are rising, the supply chain is a disaster, a leveraged speculative bubble in cryptocurrencies and unicorn growth stocks is unwinding, and the S&P 500 is down a cool 21% on the year.

And by the way, the typical 60/40 portfolio most retirees select just got demolished and is down 17.3% as of yesterday’s close.

That, and more, is the current Wall of Worry.

So, I’m guessing your clients are nervous. And why wouldn’t they be?

This is where you come in. Like it or not, their fear of bear markets is likely a core reason why your clients hired you in the first place. They want to know that you have their backs. They want to know that you’re there for them.

But remember, we don’t manage emotions, and we don’t rationalize against fear. We sit. We listen. We empathize. And we gently steer toward positive solutions.

Anyways, I wrote a sample client letter below. If you sense your clients would appreciate a comforting email or note, feel free to copy, paste, and use as like (per the usage notes below).

Client Letter Template

Keep reading with a 7-day free trial

Subscribe to The Value of Advice to keep reading this post and get 7 days of free access to the full post archives.