I wrote about what I call the Triple Whammy of advisory servicesin Part I of this series. That is:

Too Much Work

For Too many Clients

For Too Little Money

The Triple Whammy leads to frustration, burnout, low margins, overstaffing, and more.

You can read Part I here:

In this next section, I want to delve into the first aspect of the Triple Whammy: Too Much Work.

Mental Load

After our first child was born, my wife taught me the concept of ‘mental load.’ When I say ‘taught,’ I mean exasperatingly drilled it into my dense male brain.

Mental load is the invisible effort of effectively running a household. I enjoyed this description of it from Mahima Vashisht:

I had no idea mental load existed until my wife overwhelmed me with all the things she thinks about throughout the day. I said, “Holy smokes! That’s a lot! No wonder you’re so stressed!”

She looked at me and walked away.

Point taken.

The Mental Load of a Trusted Advisor

I think an awful lot about my clients. I think about their well-being, financially and otherwise. I think about how they will handle a unique situation they are confronting. I think about their estate plans and retirement distributions. I think, all the time, about their investment portfolios. I think about upcoming meetings or whether I should call or email them regarding the market. I think about whether they own too many bonds and too few stocks, or vice versa. Should I have added a commodities fund to our investment models? Long-only commodity funds are generally a horrible investment, but my goodness, they are up a lot this year.

This, and more, is the mental load of a financial planner. I suspect you relate.

We are currently working on shifting the processes that exist in our brains to workflows, written procedures, and staff support.

Yet, here is what I’ve noticed.

Our CRM helps with the mental load. Staff can help with mental load (though they can add to it in other ways). Workflows, task management systems, note taking, and administrative efficiencies help.

Yet nothing entirely releases us from the mental load and emotional toll of being a steward of our client's financial well-being. Nor would we want it that way.

The mental and emotional burden of working with clients on an ongoing basis is largely unquantified. We often think of advisor value in quantifiable ways – tax planning, behavioral investing, tax location, risk management, etc. – yet, we rarely think of our efforts in terms of the toll they exact on us.

Don’t get me wrong; this is an incredible profession.

Yet, burnout is high.

According to Barron’s:

Stress among financial advisors was already formidable and rising before the pandemic, according to a 2019 study by the Financial Planning Association, Janus Henderson, and Investopedia. At that time, 71% of financial advisors said they experienced moderate or high levels of negative stress.

But the pandemic has made the problem more acute for many financial professionals. A recent research study from Ketchum found that 52% of financial and professional services industry employees report feeling more burned out in their job now than at the pandemic’s start [Emphasis added].

The actual work, the responsibility (this is the financial future of your clients we are talking about!), and the emotional toil take their toll! Life is hard. We all know this. And as trusted advisors, we are intimately connected to the tragedies and successes of dozens of households. I don’t say ‘tragedy’ lightly. Real stuff happens, the muck of life, and we must be present to our clients as they trudge through challenges, both minor and existential.

Add to this the stress of building and running your own business or client base, staff, coworkers (if you have them), personal and professional development, and familial responsibilities.

Well, shit! No wonder we’re so tired. If not properly approached, being a family’s trusted financial planner can be exhausting work.

But what about the actual work?

My wife, some friends, and I have been working through a coaching program based on Shirzad Chamine’s book Positive Intelligence. The book (and program) help you label your saboteurs as you work to shift more into what he calls your ‘sage’ brain. My #1 saboteur?

I’m a pleaser.

Here’s the thing, I don’t know too many financial advisors who aren’t people pleasers. Most of us enter this industry due to a genuine desire to help. It’s what we do! It’s who we are! We like helping people, and we have expertise that is both high impact and in demand.

“This isn’t my saboteur,” you might argue. “Working to help people is my biggest strength.”

Yes.

And no.

In an attempt to make the people around them happy, pleasers often go too far. We give and give and give until there is nothing left to give. And then we become resentful. It’s a nasty cycle that I’m all too familiar with, professionally and personally.

Here’s the hard truth I had to confront: my clients didn’t value most of what I gave.

I want to be very clear on this.

It’s not that my clients didn’t highly value some things that I offered. It’s that they didn’t appreciate most things.

What did they value? Well, it is much easier to work in reverse and note what they didn’t value first.

Quarterly or monthly meetings (i.e. more meetings).

Performance reports.

Their actual financial plan.

Deliverables

Data

Client portals

That I would take meetings at night or on weekends for them

Being my friend.

Wining and dining.

General market commentary (i.e., stocks were up, bonds down, the Fed raised rates, blah, blah, blah).

Accountability (Though extremely valuable, it’s not valued)

Life planning (this was a hard truth for me to confront).

Flat fee or AUM pricing (seriously, no one cares except FinTwit).

Pricing in general

Fee-Only vs. Fee-Based

My credentials

Meeting me in person

Living in the same state

…and much, much more!

What Matters to Clients?

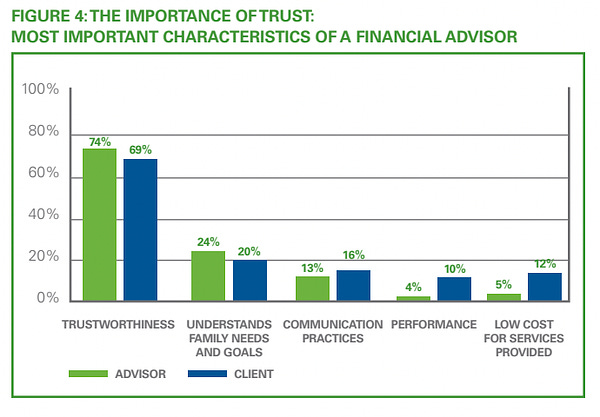

If I could synthesize what they do value, it’s this:

Working with a financial expert they trust to ensure and assure them they will be okay financially.

That’s it. There are, of course, supplementary reasons. Investment management expertise. The urge to delegate. Tax planning strategies. But those are always way down the list.

It’s the ‘okay’ part. They want to be ‘okay.’ They see extreme value in working with a trustworthy professional to ensure this happens.

And, they want this communicated to them, positively and assuredly, along the way so they can keep going.

The lesson was this: Most of the ways I attempted to please my clients were more about satisfying my ego or my ‘pleaser’ saboteur. I can do this, this, and this for you. I can be your hero.

But if you’ve read The StoryBrand, you know a vital secret: you’re not the hero. Your client is. It’s their show, after all.

Focus On What Matters

So, focus on what matters, and cut out the rest. By cutting out the fat of our service model, we inch away from the scourge of ‘too much work.’ Here are a few examples of how my wealth management firm, Trailhead Planners, has approached that.

Prospect Meetings: We used to offer a free 30-minute introductory phone call, and a free 60-minute in-person (or Zoom) meeting before a client signed on. Now, we offer one 20-minute phone call. Less time with prospects has not affected our conversion rate in any meaningful way. (By the way, I’m not sure conversion rate matters as much for a Focus 50 Firm. Ultimately, you only want to ‘convert’ ideal clients while taking a pass on everyone else).

First Year Onboarding: We used to schedule 5-8 meetings throughout the first year to cover every aspect of a client’s financial plan. We’ve simplified this dramatically and now offer a 3-meeting full financial planning process called 3 Steps to Embark. We charge separately for this engagement. After the initial three meetings, assuming both client and advisor want to move forward, they roll into our annual calendar.

Less Meeting Prep: I’m a notorious over-prepper for meetings. I want to be ready for every possible question a client could ask. Yet, they rarely do ask all the questions, and we usually spend most of our time on one or two critical topics. So I have been forcing myself to prepare less specifically for meetings and instead use the sessions to touch on what is essential and ‘action items.’ Work gets cued up for my team and me at the meeting, and we complete it on an agreed-upon timetable.

Work Happens Behind the Scenes: In the past, I used meetings to do a lot of planning on the fly. This was inefficient and ultimately necessitated more meetings, a time burden on both my client and me. Now, meetings are for values-based conversation, life updates, financial planning or investment updates (if valuable and valued), and cueing up a list of items to accomplish (on my end or their end). Once my team does the work, we offer to present over email, phone, or in a short meeting.

Annual Cycle: When we first started Trailhead, I admired all the firms that met with their clients quarterly. I thought, “This is how great financial planning happens and if you don’t like it, get out.” I was wrong and, once again, trying to make myself the hero. Great financial planning happens when we offer value to our clients the way they want to receive it. So we shifted to Spring and Fall meetings. Some clients only want to meet with me once a year. As long as we accomplish what must be accomplished, that’s fine, and we stay in touch in other ways.

Niched: I’m a converted generalist. At around 30 clients, I had three or four core groups of clients. There was no efficiency to be found in how to serve them. My physician clients needed one service model and area expertise; my retirees required another. So last year, we decided to work solely with prospective retirees, which has opened up a great deal of mind space and firm efficiency.

Raised Our Minimum Fee: Another angle on ‘too much work’ is too much uncompensated work. Raising our minimum pricing has helped us focus on what we do best for the right client, instead of doing everything we can for the wrong client.

Zeroing in on a Target Client Count: We have no intentions of scaling to the moon. We are targeting 50 clients per advisor and we are being very intentional about who we work with. Onboarding a new client is by far the most time-intensive service we offer. By limiting the onboarding of non-ideal clients, even if they would be fine clients for 2-3 years, we’ve dramatically reduced our workload, both now and in the future. We’ve also increased our capacity to offer our time, perspective, and proactive care for our ongoing ideal clients even as gain flexibility and work-life balance. Win-Win!

To Conclude

I think the answer to most of the issues described above (and more!) is The Focus 50. But hey, I’m biased! Ultimately, the goal is to reduce your non-essential mental load to the extent possible so that you can offer your highest value self and service to your ideal clients. They value you. They want to work with you.

By tightly defining your service and staying lean, you can be there, fully and actively, for them, especially when they need it most.

Next time, we’ll talk about the second part of the Triple Whammy: Too Many Clients.

Your Cause is Righteous.

Summer Jivin’

Forget all other Eric Clapton. Give me Derek and the Dominos with Clapton on guitar and vocals and Bobby Whitlock on keys and vocals. The desperation in Bobby’s lead vocals and harmonies offers so much emotion to Clapton’s straighter delivery. “Anyday” has been on repeat in my house lately.

This is bliss.